Does New Hampshire Have An Individual Income Tax . new hampshire is a state that doesn't have a personal income tax. new hampshire does not tax earned income but does tax dividends and interest. New hampshire’s senate passed legislation to phase out the investment income tax by 1% per year over five. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. there is no tax on personal income from wages and salaries in new hampshire. use our income tax calculator to find out what your take home pay will be in new hampshire for the tax year. However, currently, the state has a 4% tax on dividends and interest. to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax on two.

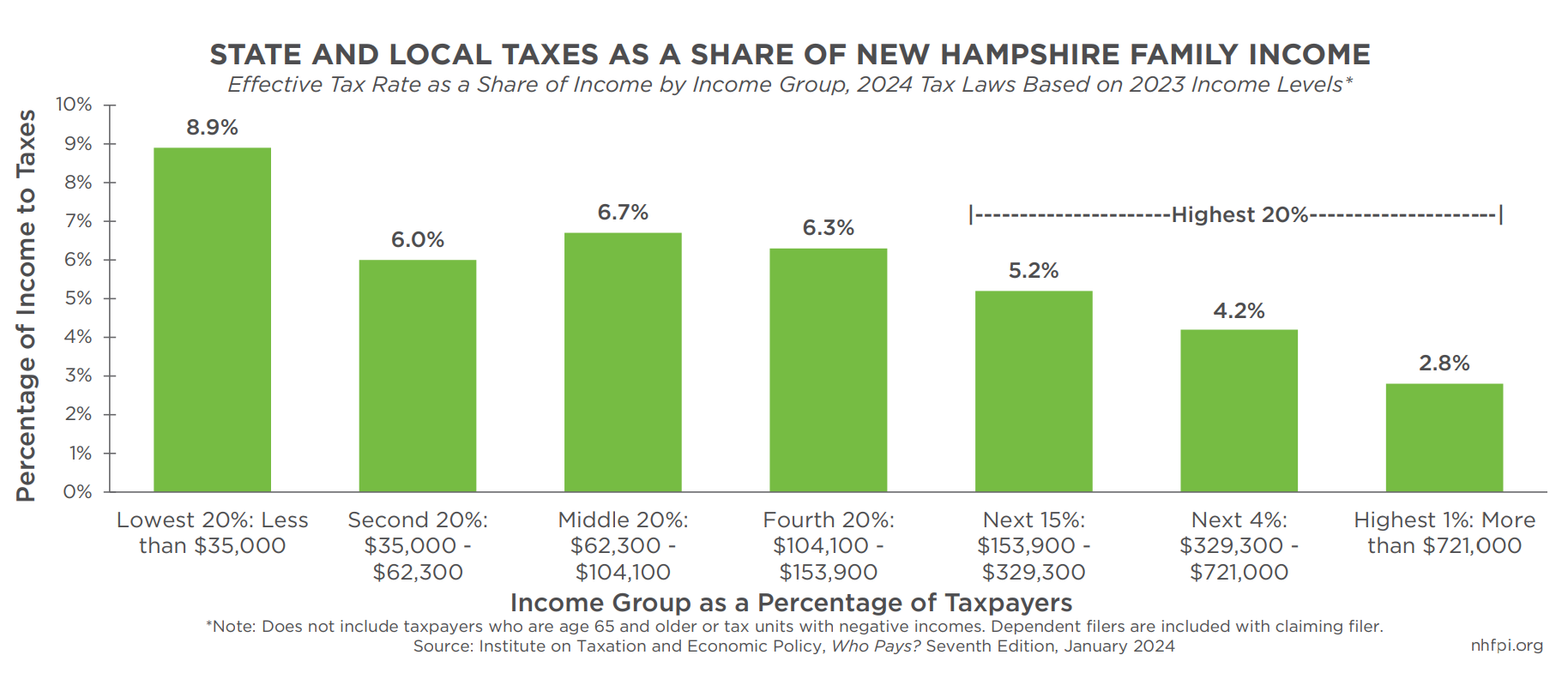

from nhfpi.org

to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. there is no tax on personal income from wages and salaries in new hampshire. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax on two. new hampshire is a state that doesn't have a personal income tax. new hampshire does not tax earned income but does tax dividends and interest. New hampshire’s senate passed legislation to phase out the investment income tax by 1% per year over five. However, currently, the state has a 4% tax on dividends and interest. use our income tax calculator to find out what your take home pay will be in new hampshire for the tax year.

Granite Staters with Lowest Have Highest Effective State and

Does New Hampshire Have An Individual Income Tax new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. there is no tax on personal income from wages and salaries in new hampshire. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. use our income tax calculator to find out what your take home pay will be in new hampshire for the tax year. new hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 4% tax on dividends and interest. new hampshire does not tax earned income but does tax dividends and interest. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax on two. New hampshire’s senate passed legislation to phase out the investment income tax by 1% per year over five.

From taxfoundation.org

State Tax Rates and Brackets, 2021 Tax Foundation Does New Hampshire Have An Individual Income Tax to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. there is no tax on personal income from wages and salaries in new hampshire. new hampshire does not tax earned income but does tax dividends and interest. New hampshire’s senate passed legislation to phase out the investment income. Does New Hampshire Have An Individual Income Tax.

From hereinnewhampshire.com

Does NH Have Tax? Here In New Hampshire Does New Hampshire Have An Individual Income Tax new hampshire does not tax earned income but does tax dividends and interest. to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. new hampshire is a state that doesn't have a personal income tax. though new hampshire does not impose a comprehensive individual income tax, as. Does New Hampshire Have An Individual Income Tax.

From pioneerinstitute.org

New Hampshire Tax Burden Dramatically Less than Massachusetts Blog Does New Hampshire Have An Individual Income Tax new hampshire does not tax earned income but does tax dividends and interest. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. new hampshire is a state that doesn't have a personal income tax. New hampshire’s senate passed legislation to phase out the investment income tax by 1%. Does New Hampshire Have An Individual Income Tax.

From www.youtube.com

How NEW HAMPSHIRE Taxes Retirees YouTube Does New Hampshire Have An Individual Income Tax New hampshire’s senate passed legislation to phase out the investment income tax by 1% per year over five. there is no tax on personal income from wages and salaries in new hampshire. However, currently, the state has a 4% tax on dividends and interest. new hampshire has a flat 3.00 percent individual income tax rate levied only on. Does New Hampshire Have An Individual Income Tax.

From nhfpi.org

Report Shows Higher Effective Tax Rates for Residents with Low Does New Hampshire Have An Individual Income Tax new hampshire does not tax earned income but does tax dividends and interest. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. use our income tax calculator to find out what your take home pay will be in new hampshire for the tax year. to access general. Does New Hampshire Have An Individual Income Tax.

From lyfeaccounting.com

TaxFree States? Pay No Tax in These 9 TaxFriendly States! Does New Hampshire Have An Individual Income Tax new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. new hampshire does not tax earned income but does tax dividends and interest. use our income tax calculator to find out what your take home pay will be in new hampshire for the tax year. New hampshire’s senate passed. Does New Hampshire Have An Individual Income Tax.

From taxedright.com

New Hampshire Taxes Taxed Right Does New Hampshire Have An Individual Income Tax However, currently, the state has a 4% tax on dividends and interest. new hampshire is a state that doesn't have a personal income tax. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. though new hampshire does not impose a comprehensive individual income tax, as is the practice. Does New Hampshire Have An Individual Income Tax.

From nhfpi.org

An Overview of New Hampshire’s Tax System New Hampshire Fiscal Policy Does New Hampshire Have An Individual Income Tax However, currently, the state has a 4% tax on dividends and interest. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax on two. new hampshire is a state that doesn't have a personal income tax. there is no tax on. Does New Hampshire Have An Individual Income Tax.

From exodbccbq.blob.core.windows.net

Is There Inheritance Tax In New Hampshire at Cindy Pittman blog Does New Hampshire Have An Individual Income Tax to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. new hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 4% tax on dividends and interest. new hampshire has a flat 3.00 percent individual income tax rate levied only on. Does New Hampshire Have An Individual Income Tax.

From taxfoundation.org

State Tax Reliance Individual Taxes Tax Foundation Does New Hampshire Have An Individual Income Tax new hampshire does not tax earned income but does tax dividends and interest. to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. new hampshire is a state that doesn't have a personal income tax. though new hampshire does not impose a comprehensive individual income tax, as. Does New Hampshire Have An Individual Income Tax.

From milestonefinancialplanning.com

Does New Hampshire Have an Tax? What to Know About the Interest Does New Hampshire Have An Individual Income Tax to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. However, currently, the state has a 4% tax on dividends and interest. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax on. Does New Hampshire Have An Individual Income Tax.

From hereinnewhampshire.com

Does NH Have Tax? Here In New Hampshire Does New Hampshire Have An Individual Income Tax New hampshire’s senate passed legislation to phase out the investment income tax by 1% per year over five. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. new hampshire is a state that doesn't have a personal income tax. there is no tax on personal income from wages. Does New Hampshire Have An Individual Income Tax.

From taxfoundation.org

How Much Does Your State Rely on Individual Taxes? Does New Hampshire Have An Individual Income Tax new hampshire is a state that doesn't have a personal income tax. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax on two. new hampshire does not tax earned income but does tax dividends and interest. there is no. Does New Hampshire Have An Individual Income Tax.

From nhfpi.org

Granite Staters with Lowest Have Highest Effective State and Does New Hampshire Have An Individual Income Tax new hampshire is a state that doesn't have a personal income tax. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. new hampshire does not tax earned income but does tax dividends and interest. New hampshire’s senate passed legislation to phase out the investment income tax by 1%. Does New Hampshire Have An Individual Income Tax.

From golookup.com

New Hampshire Tax Law, New Hampshire Tax Laws Does New Hampshire Have An Individual Income Tax there is no tax on personal income from wages and salaries in new hampshire. to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. new hampshire does not tax. Does New Hampshire Have An Individual Income Tax.

From www.taxuni.com

New Hampshire Tax Calculator 2023 2024 Does New Hampshire Have An Individual Income Tax new hampshire is a state that doesn't have a personal income tax. to access general information, forms and instructions, laws and rules, and frequently asked questions, please select a tax type. though new hampshire does not impose a comprehensive individual income tax, as is the practice in the vast majority of states, it does levy a tax. Does New Hampshire Have An Individual Income Tax.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Does New Hampshire Have An Individual Income Tax However, currently, the state has a 4% tax on dividends and interest. New hampshire’s senate passed legislation to phase out the investment income tax by 1% per year over five. there is no tax on personal income from wages and salaries in new hampshire. use our income tax calculator to find out what your take home pay will. Does New Hampshire Have An Individual Income Tax.

From www.taxpolicycenter.org

How do state and local individual taxes work? Tax Policy Center Does New Hampshire Have An Individual Income Tax However, currently, the state has a 4% tax on dividends and interest. new hampshire has a flat 3.00 percent individual income tax rate levied only on interest and dividends income. use our income tax calculator to find out what your take home pay will be in new hampshire for the tax year. to access general information, forms. Does New Hampshire Have An Individual Income Tax.